Introduction

When goods move across oceans or borders, they face countless risks — from rough weather and handling damage to theft or loss at sea. For importers, exporters, and logistics managers, even one mishap can lead to major financial losses. That’s where marine insurance becomes essential.

So, what is marine insurance? It’s a specialized type of coverage that protects cargo, vessels, and freight during transit — whether by sea, air, or land. If your shipment is damaged, lost, or delayed, marine insurance helps absorb the financial impact and keeps your business moving.

As global trade expands across Asia’s key shipping routes — including Singapore, Malaysia, Thailand, Cambodia, China, and India — the need for dependable marine cargo insurance is stronger than ever. In this guide, you’ll discover how marine insurance works, why it’s essential, and what a typical marine insurance policy covers.

Key Takeaways

- Marine insurance protects cargo, vessels, and freight from financial loss during transit by sea, air, road, or rail.

- It covers risks like theft, damage, accidents, and natural disasters, while excluding delays, poor packaging, and inherent vice.

- Common policy types include cargo, hull, freight, and liability insurance, with optional add-ons for war, strikes, and terrorism.

- Businesses of all sizes — from exporters to e-commerce brands — benefit from marine insurance to safeguard goods, revenue, and reputation.

What Is Marine Insurance?

Marine insurance is a contract that protects businesses from financial losses while transporting goods by sea, air, road, rail, or inland waterways. It covers cargo in transit and damage to vessels, machinery, or equipment.

Marine insurance also supports international trade compliance, often linking to terms like CIF (Cost, Insurance and Freight) and FOB (Free On Board), which define who bears the risk at different stages of shipping. In India, marine insurance is governed by the Marine Insurance Act, 1963 and regulated by the IRDAI, ensuring legal protection and secure cross-border shipping.

Why Is Marine Insurance Important?

Shipping goods internationally or regionally comes with a range of risks — from rough seas and extreme weather to theft, mishandling, and even piracy. Just one incident can lead to major financial losses, making marine insurance a critical safeguard for exporters, importers, and logistics providers.

With the right coverage in place, businesses can:

- Protect their investment: Recover the value of damaged or lost cargo.

- Ensure legal compliance: Many international shipping contracts require marine insurance.

- Maintain smooth operations: Minimize disruptions caused by delays or accidents.

- Gain peace of mind: Focus on growth without worrying about transit risks.

In short, marine insurance acts as a financial safety net — helping companies navigate the unpredictable challenges of global trade with confidence.

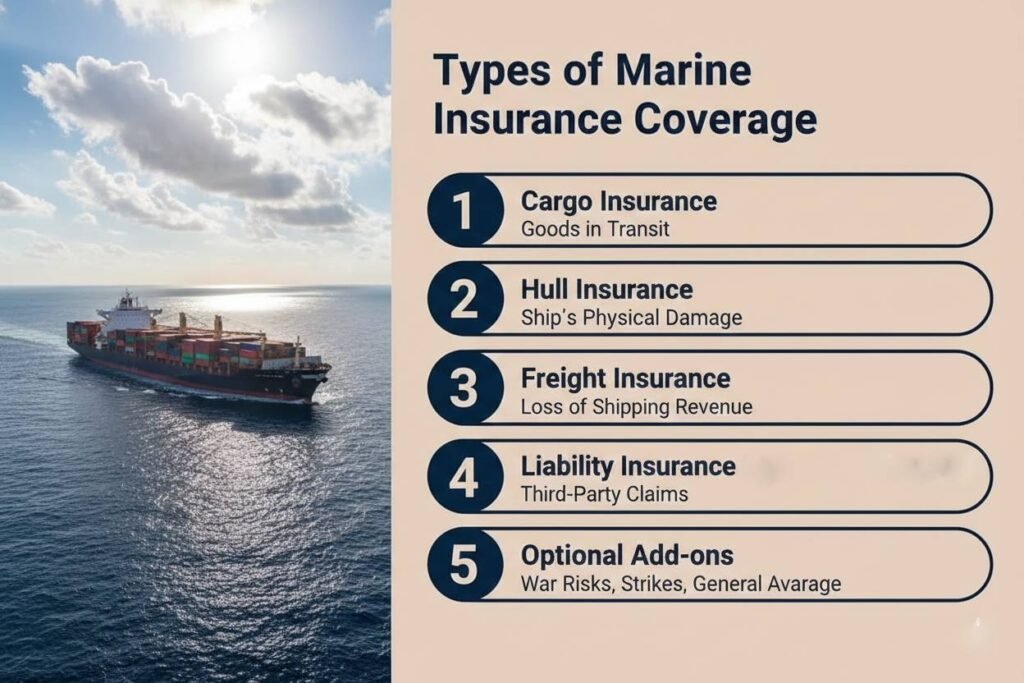

Types of Marine Insurance Coverage

Marine insurance isn’t one-size-fits-all. Depending on what you’re shipping and how it’s transported, different types of coverage protect specific aspects of the journey.

Here are the main categories:

a):- Cargo Insurance

Cargo insurance covers goods while they are in transit by sea, air, road, rail, or inland waterways. It protects against risks like theft, accidental damage, and loss during loading, unloading, and transportation.

b):- Hull Insurance

Hull insurance is designed for shipowners. It covers physical damage to the vessel itself, including its machinery, equipment, and sometimes collision liabilities.

C):- Freight Insurance

Freight insurance protects the freight charges a carrier expects to earn. If cargo is damaged or lost and freight payment cannot be collected, this policy helps recover that financial loss.

D):- Liability Insurance (Protection & Indemnity)

This type of marine insurance covers third-party legal liabilities. It includes risks such as crew injury, damage to other vessels or property, cargo liabilities, and environmental pollution claims.

E):- Optional Add-ons

Depending on the route and risk level, additional coverage can include:

- War risk insurance

- Strike and civil commotion coverage

- Terrorism protection

Choosing the right marine insurance policy depends on your cargo type, shipping route, and risk exposure. A well-structured policy ensures every stage of the journey is protected.

What Does Marine Insurance Cover?

A marine insurance policy outlines the specific risks and protections for your cargo, vessels, or freight. Understanding what’s covered — and what’s excluded — helps businesses avoid costly surprises and make informed decisions.

Typical Coverage Includes:

- Perils of the Sea Protection against natural disasters like storms, grounding, or sinking.

- Accidents Covers fire, explosions, collisions, or derailments during land, sea, or air transport.

- Theft and Piracy Safeguards against cargo theft, hijacking, or pilferage.

- Loading and Unloading Damage Covers loss or damage during handling, loading, or unloading of goods.

- General Average Compensates cargo owners when part of the shipment is intentionally sacrificed to save the vessel and remaining cargo during emergencies.

- Sue and Labor Clause Reimburses expenses incurred by the insured to minimize or prevent further loss.

Common Exclusions:

- Willful Misconduct Losses caused intentionally by the insured are not covered.

- Inherent Vice Natural deterioration or spoilage of goods, such as perishables, is excluded.

- Inadequate Packaging Damage due to poor or insufficient packaging is not covered.

- Loss Due to Delay Financial losses from transit delays are typically excluded.

- War and Strikes Damage from war, riots, revolutions, or strikes is excluded unless added as optional coverage.

By clearly understanding the scope of coverage and exclusions, businesses can ensure their marine cargo insurance provides the right level of protection for every shipment — no matter where it’s headed.

Key Principles of Marine Insurance

Marine insurance operates on a set of foundational principles that ensure fairness, transparency, and legal integrity between the insurer and the insured. Understanding these marine cargo principles helps businesses make informed decisions, file valid claims, and maintain trust throughout the shipping process.

1. Principle of Utmost Good Faith (Uberrimae Fidei)

Marine insurance is built on honesty. Both you and the insurer must share all important information about the cargo, route, and risks before the policy starts. If any key detail is hidden or misrepresented, the insurer can cancel the policy or deny a claim. Simply put, clear and truthful communication keeps your marine insurance coverage valid and reliable.

2. Principle of Indemnity

Marine insurance is designed to compensate for actual losses — not to generate profit. The insured receives reimbursement equal to the financial loss incurred, ensuring that they are restored to their original position before the incident, but not better off.

3. Principle of Insurable Interest

To claim compensation, the insured must have a legitimate financial interest in the cargo or vessel. This means they would suffer a financial loss if the goods were damaged or lost. Without this interest, the insurance contract has no legal standing.

4. Principle of Proximate Cause

Only losses that are directly caused by insured risks are covered. For example, if a storm damages the cargo and storm damage is listed in the policy, the claim is valid. This principle helps determine whether the cause of loss is closely linked to the insured peril.

5. Principle of Subrogation

Once the insurer pays out a claim, they gain the right to recover the amount from any third party responsible for the loss. This prevents the insured from receiving double compensation and allows the insurer to pursue legal recovery.

6. Principle of Contribution

If the same cargo is insured under multiple policies, each insurer shares the claim payout proportionally. This ensures fair distribution of liability and prevents the insured from claiming the full amount from more than one provider.

How Does Marine Insurance Work?

Understanding how marine insurance works helps businesses protect their cargo and vessels with confidence. Here’s a simple step-by-step breakdown of the process:

1. Select a Marine Insurance Policy

Choose the type of coverage that fits your shipment — whether it’s cargo, hull, freight, or liability insurance. The right policy depends on what you’re shipping, how it’s being transported, and the risks involved.

2. Declare Shipment Details

Provide accurate information about the cargo, including its value, packaging, and shipping route. These details are crucial for determining coverage and ensuring proper compensation in case of loss or damage.

3. Pay the Premium

Premiums are calculated based on several factors — such as cargo value, transport mode, destination, and risk exposure. Higher-risk shipments may carry higher premiums.

4. Transport the Goods

Once insured, your cargo is covered throughout its journey — whether it’s moving by sea, air, road, or rail.

5. File a Claim (If Needed)

If a loss or damage occurs, submit a claim with supporting documents like invoices, shipping papers, and proof of damage. The insurer will assess the claim and provide compensation based on the terms of your marine insurance policy.

Who Needs Marine Insurance?

Marine insurance isn’t just for large shipping companies. Any business or individual involved in moving goods across borders — by sea, air, or land — can benefit from this coverage. Whether you’re shipping bulk containers or small parcels, the risks are real, and the protection is essential.

Here are some of the most common users of marine insurance:

- Exporters and Importers Protects valuable shipments from financial loss due to damage, theft, or delays during transit.

- Freight Forwarders and Logistics Companies Ensures that client cargo is covered while in storage, handling, or transportation — helping maintain trust and operational continuity.

- E-commerce Brands and Manufacturers Safeguards products shipped regionally or internationally, especially high-value, fragile, or time-sensitive items.

Even small shipments can face unexpected challenges like accidents, piracy, or natural disasters. With a marine insurance policy in place, businesses of all sizes can protect their cargo, revenue, and reputation — and ship with confidence.

How to Choose the Right Marine Insurance Policy

Choosing the right marine insurance policy ensures your cargo and vessels are protected — without overpaying for coverage you don’t need. Here are some key tips to help you make an informed decision:

1):- Understand Your Shipping Risks

Start by assessing what you’re shipping, its value, and the route. High-value, fragile, or long-distance shipments may require more comprehensive coverage to account for increased exposure to damage or delay.

2):- Compare Policy Coverage and Exclusions

Not all marine insurance policies are created equal. Review what’s included, what’s excluded, and the limits of liability. This helps you avoid gaps in protection and ensures the policy matches your business needs.

3):- Check the Insurer’s Reputation

Work with insurers known for reliable claim handling and fast settlements. Reading reviews, checking ratings, or asking for recommendations can help you choose a trustworthy provider.

4):- Consider Regional Expertise

For shipments across Asia, it’s wise to choose insurers familiar with trade routes through Singapore, Malaysia, Thailand, Cambodia, China, and India. Local expertise can lead to better risk assessment and tailored coverage.

5):- Maintain Proper Documentation

Keep all relevant paperwork — invoices, shipping documents, and proof of packaging — organized and accessible. Good documentation speeds up claims and ensures smoother settlements if something goes wrong.

Read More: What is Cargo Insurance? A Complete Guide to Types, Benefits, and Business Needs

FAQ Section

Q1. What is marine insurance and why do I need it?

Ans: Marine insurance protects cargo, vessels, and freight from financial loss during transit — by sea, air, road, or rail. It’s essential for businesses shipping goods internationally, covering risks like theft, damage, delays, or accidents.

Q2. Does marine insurance only cover ocean shipments?

Ans: No. Marine insurance covers all modes of transport, including sea, air, road, rail, and inland waterways. It provides protection across multimodal logistics, ensuring your cargo is safe throughout the entire journey.

Q3. What does a marine insurance policy typically cover?

Ans: Typical coverage includes:

- Natural disasters (storms, sinking)

- Accidents (fire, collision)

- Theft and piracy

- Damage during loading and unloading

- General average and sue & labor expenses

Q4. Is marine insurance mandatory for international trade?

Ans: While not always legally required, many trade contracts and Incoterms (like CIF or FOB) make marine insurance a contractual obligation. Even when optional, it is strongly recommended for risk management and financial protection.

Conclusion

Marine insurance is more than just a safety net — it’s a strategic tool for protecting your cargo, vessels, and business from the many risks of shipping. From theft and accidents to natural disasters, delays, and handling errors, international and regional trade comes with unpredictable challenges.

By understanding what marine insurance is, the types of coverage available — including cargo insurance coverage — the principles that govern it, and how it works, businesses can make smarter decisions to safeguard their shipments. Choosing the right marine insurance policy ensures financial protection, legal compliance, and peace of mind — whether you’re an exporter, importer, freight forwarder, or e-commerce brand.

With trade booming across Asia — including Singapore, Malaysia, Thailand, Cambodia, China, and India — marine insurance is essential for keeping your goods, revenue, and reputation secure. Before your next shipment leaves port, make sure your cargo is covered with the right cargo insurance coverage and your business is prepared for the unexpected.